flow through entity private equity

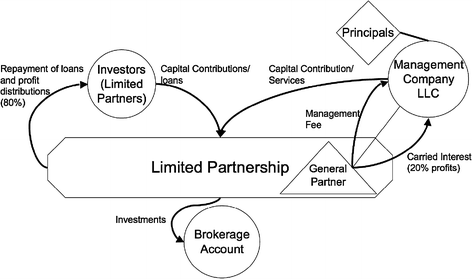

Under US tax law partnerships are flow-through entities aka tax transparent Generally not subject to US federal income tax at partnership level Partners taxed on. States real property interests USRPIs or interests in flow-through entities themselves engaged in a US.

A private equity fund or other investor in purchasing a corporation may wish to establish an LLC or other pass-through entity as a holding vehicle permitting flexible.

. The model rules refer to flow-through entities. 1 Financial Sponsor Sponsor in image. Fund invests in other private equity funds.

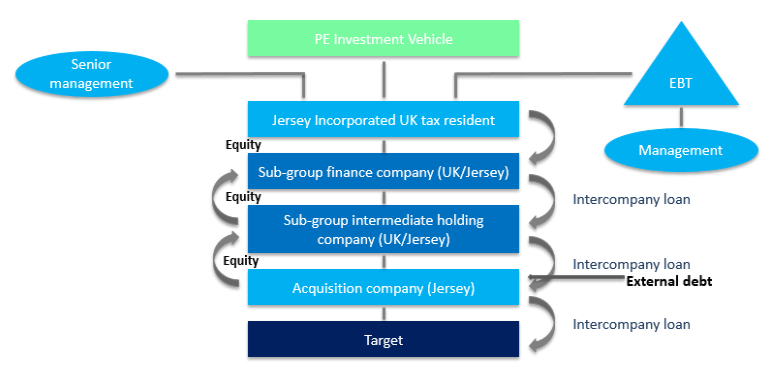

Private equity structure - principal. A private equity or hedge fund located in the United States will typically be structured as a limited partnership due to the lack of an entity-level tax on. Indebtedness and cannot invest in flow-through operating entities except through blocker structures as discussed below.

In addition the non-US. The particular focus of this blog post however is on three potential fund structures that may be used by a private equity fund buyer when acquiring a portfolio company that is. Partners of the GP of fund the management company.

Need to invest through a parallel fund that excludes tainted income or have the right to opt-out of certain investments if the government investor is a controlled entity. Flow-Through Entities Based on this Tax Court decision private equity funds are likely to consider using a non-US. The GP and LP equity are now in distinct entities and the JV LLC Agreement dictates how cash flow is divided between the two entities as well as how control is allocated.

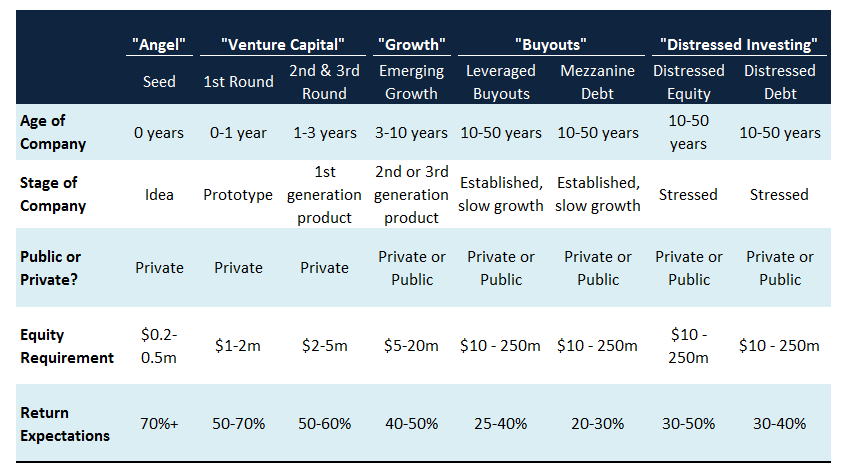

They encourage the creation and. Raising a private equity fund requires two groups of people. Some of the most active investors in private equity funds are.

GP makes the investment decisions for the fund. An entity is considered a flow-through entity if it is treated as tax transparent in the jurisdiction it was created which we understand to mean. Basic US Tax Regime.

Trade or business flow-through operating entities. Blocker corporation to hold an. Blocker corporation rather than a US.

Private Equity Funds are a way to make sure that there is a transfer of ownership of the South African economy into the hands of Black people. The team of individuals that will identify execute and manage investments in privately.

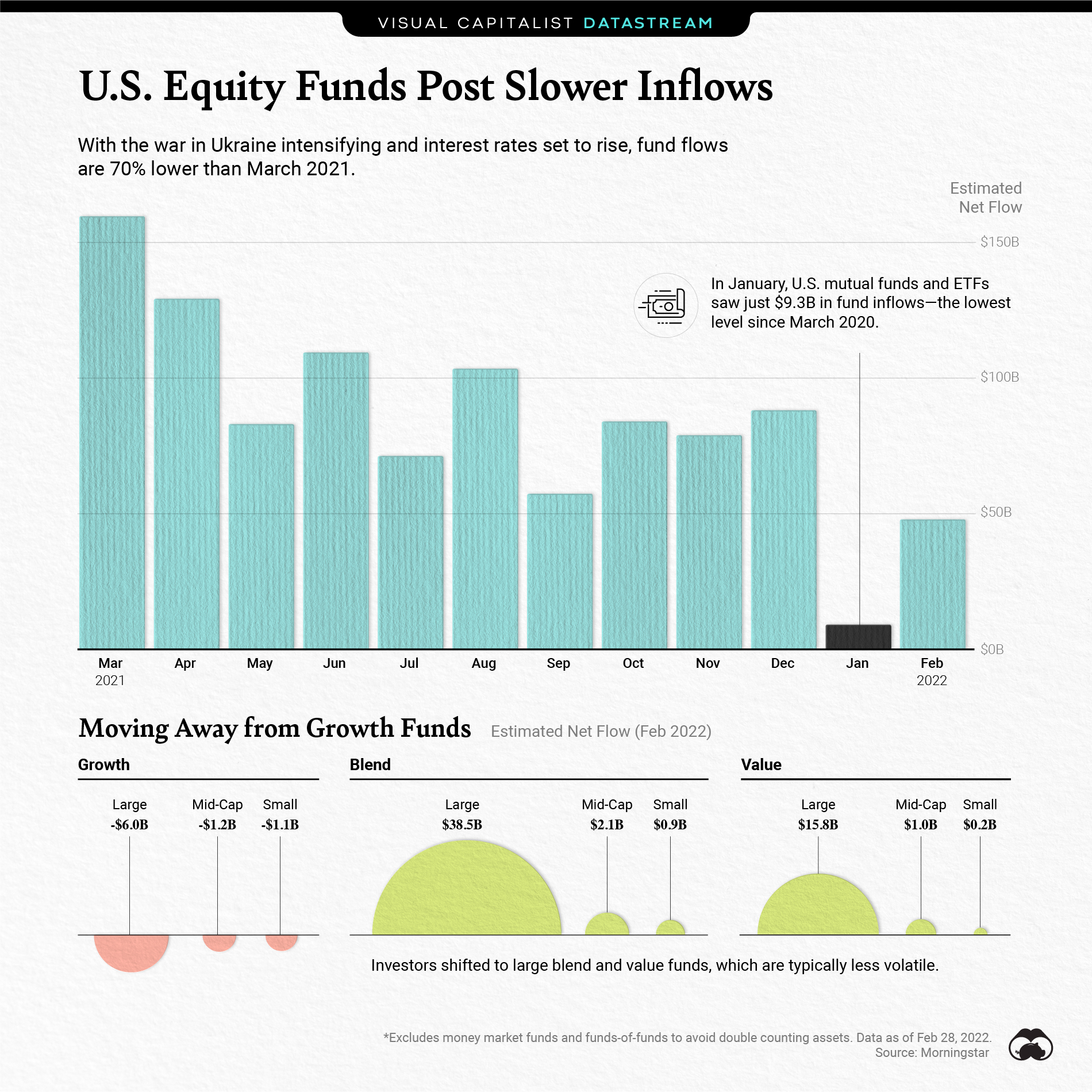

U S Equity Funds Post Slower Inflows Visual Capitalist

4 Types Of Business Structures And Their Tax Implications Netsuite

Growth Equity Primer Expansion Capital Investment Strategy

Tips For Realizing Qualified Small Business Stock Benefts For Fund Investments By Neal Gerber Eisenberg Issuu

Techniques For Preserving Qualified Small Business Stock Benefits For Early Stage Investments By Neal Gerber Eisenberg Issuu

How Some Taxpayers Are Using Pass Through Entity Taxes To Avoid The Salt Cap Limit The Compardo Wienstroer Conrad Janes Team

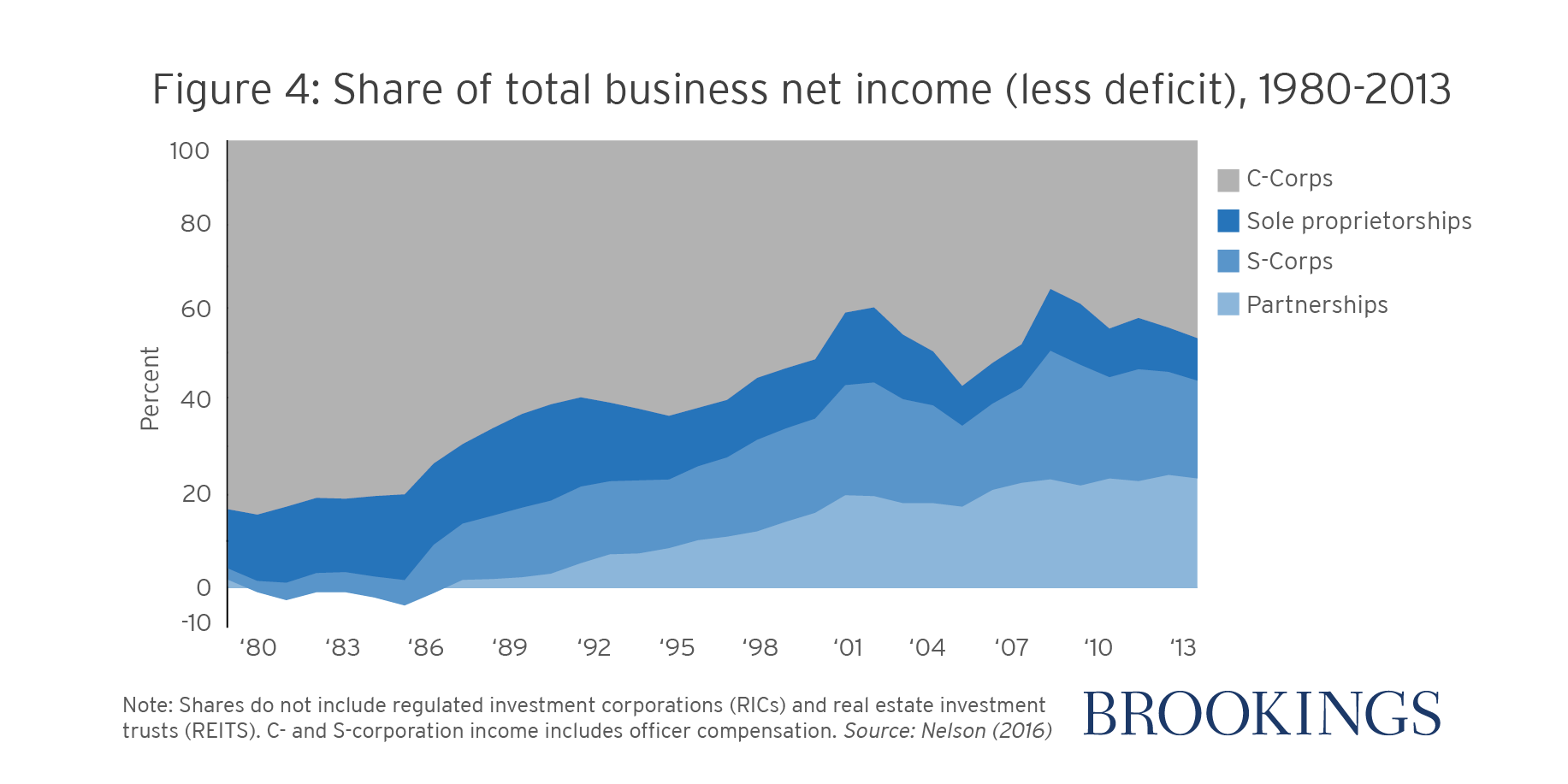

9 Facts About Pass Through Businesses

Private Equity Regulation A Comparative Analysis Springerlink

A Guide To Family Offices And Their Increasing Popularity Toptal

Private Equity Acquisition Structures Lexology

What Is Carried Interest And How Is It Taxed Tax Policy Center

U S Energy And Private Equity Mercer Capital

Tax Considerations For Private Equity Funds And Investors Bmss Llc

Lp Corner Us Private Equity Fund Structure The Limited Partnership Allen Latta S Thoughts On Private Equity Etc

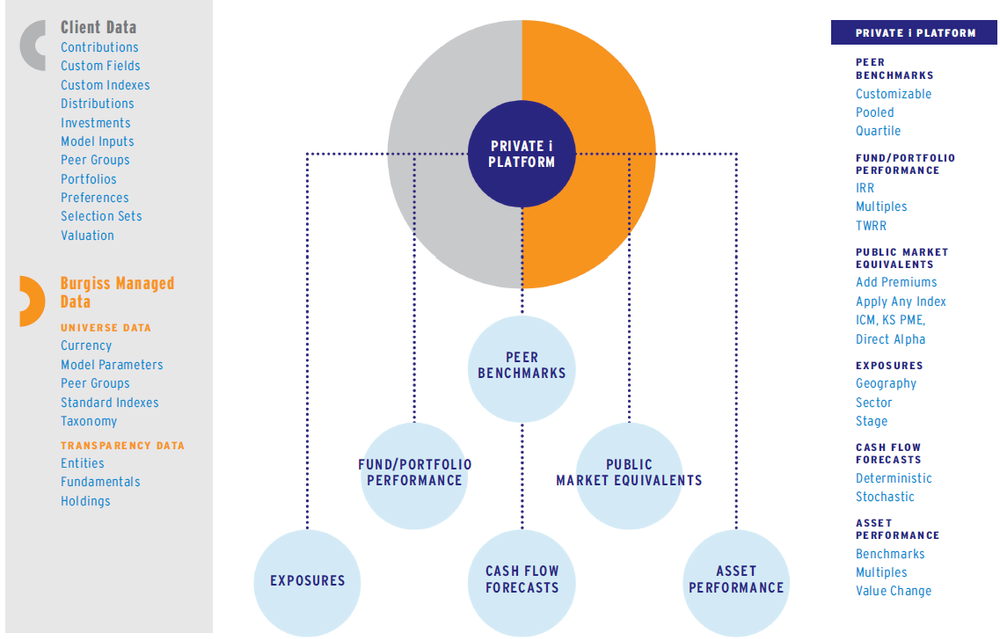

The Private I Platform Burgiss

Private Equity Cash Flow Institutional Venture Partners Business Waterfall Text People Investment Png Pngwing

Private Equity Meaning Investments Structure Explanation

4 Types Of Business Structures And Their Tax Implications Netsuite

Top Private Equity Firms Investing In Sports Teams Media And More